XTB - Overview

XTBs bring together the income, certainty and capital stability of individual corporate bonds with the transparency and liquidity of the ASX market.

Benefits of XTBs

When investing in XTBs, you get:

- Choice & access to a wide range of corporate bonds from ASX 100 companies, previously only available to institutional investors;

- A regular and predictable income stream so you can match your income to your cash flow requirements;

- An increase in return when compared to Term Deposits, for an increase in risk of a corporate bond over a Term Deposit;

- Capital stability and greater security of capital repayment than shares and hybrids;

- Available to SMSF as part of their investment portfolio.

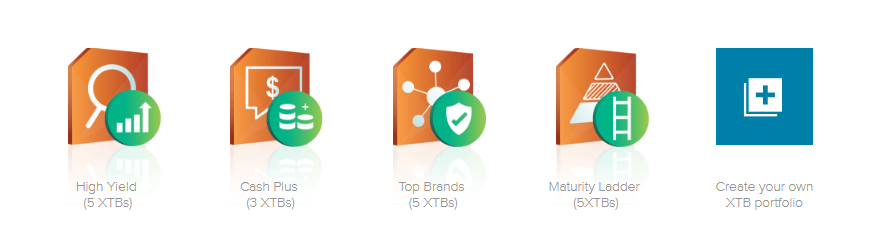

Build your XTB portfolio & calculate your income

Simply go to http://xtbs.com.au/cash-flow-tool/ to start building your own portfolio of up to 10 XTBs around targeted investment themes.

You will be asked to:

-

Choose the right Starter Portfolio for you from the four portfolios available (High Yield, Cash Plus, Top Brands and Maturity Ladder) or create your own portfolio.

-

If you chose a Starter portfolio, enter your investment amount which will be allocated according to the portfolio weightings across the pre-selected XTBs.

If you chose to build your own portfolio, select up to 10 XTBs and either enter an overall investment amount to be split equally across your chosen XTBs, or select individual investment amounts for each XTB.

All the XTBs currently available are listed on the available XTB list.

-

Calculate your cash flow using the tool on the XTB website.

WANT TO KNOW MORE? – VIEW OUR INFOGRAPHIC EXPLAINING HOW CORPOATE BONDS WORK – Link to https://xtbs.com.au/corporate-bonds-infographic/.

How do I invest in XTBs?

Investing in corporate bonds via XTBs is similar to investing in equities. Simply place an order online through our amscot account.

To start trading, follow these steps:

- Use the XTB interactive table to select the XTB that meets your needs and read the relevant Product Disclosure Statement (PDS) for the XTBs you have selected.

- Login to your IRESS Trading account and enter the ASX 6-letter code (starting with YTM) of the XTB product you wish to trade in the Trade icon.

- Enter the quantity or value of units you wish to buy or sell, the price and the validity of your order.

- Your order is placed; your new XTB units are transferred to your CHESS holdings and you’ll see them in your portfolio.

Tell me more about XTBs

- XTBs (Exchange Traded Bond units) provide access to the returns of individual corporate bonds on the ASX.

- XTBs give you the income and capital repayment of specific, individual corporate bonds (e.g. Telstra, Woolworths or BHP bonds).

- XTBs trade on ASX and their performance closely follows their individual bond performance in the wholesale market and are 100% backed by the actual bonds.

- Each XTB has the same maturity date and coupon payment frequency as its corporate bond (e.g. a 3-year bond with a coupon of 5% = a 3-year XTB with a coupon of 5%).

- There are currently more than 50 XTBs available (including a mix of fixed and floating) across a broad range of larger ASX listed companies covering the majority of key industry sectors.

- For each corporate bond, a new XTB is quoted on ASX, each with its own ASX 6-letter code (all codes start with YTM, e.g. the Woolworths XTB is YTMWOW).

What costs are involved?

- The yield and price of each XTB reflects the yield and price of the underlying bond, after fees and expenses. For fixed-rate XTBs, the fees are 0.4% of the face value each year for the life of the bond, and 0.2% p.a. for floating-rate XTBs.

- The impact of the XTB fee is to lower the yield of the XTB compared with the bond. A corporate bond trading in the wholesale market at a yield of 4.8% becomes an XTB trading on ASX at about 4.4%.

- Investors can allocate as little as $500 to each XTB selected.

Who are XTBs suitable for?

- If you match one of these types, you should take a closer look at XTBs

- Investors seeking a regular, reliable income stream

- Investors looking for capital stability in their investments and Self Managed Super Funds (SMSFs)

- Investors looking to build their investment portfolio via direct investments on ASX

- Investors seeking to diversify their portfolio and blend fixed income with equity and property investments

What risks should I be aware of?

-

Credit risk: the risk the bond issuer defaults on coupon or principal payments

- Liquidity risk: the risk you will not be able to sell your XTBs on ASX

- Market risk: the risk of adverse market movements that impact the bond and XTBs

- Trust risk: the risk the Trust and Responsible Entity structure fails

For more information on risks, check the PDS (Product Disclosure Statements).

Find out more in just 2 minutes